Porter’s Five Forces

Industrial organization is a field of study that examines the differences between the “perfect” competition among companies found in economics textbooks, and the “imperfect” competition found in the real world. One tool derived from the field is Michael Porter’s “five forces” analysis, from the very beginning of his seminal book, Competitive Strategy.

Porter developed the five forces analysis as a more rigorous variation of the widely used SWOT analysis. The framework focuses on the level of competition within an industry to evaluate a company’s strategic position. In contrast to the SWOT analysis, the five forces survey the business environment, rather than examining a particular firm itself. Along with the PEST analysis, it digs deeper into the Opportunities and Threats of the SWOT.

The Five Forces

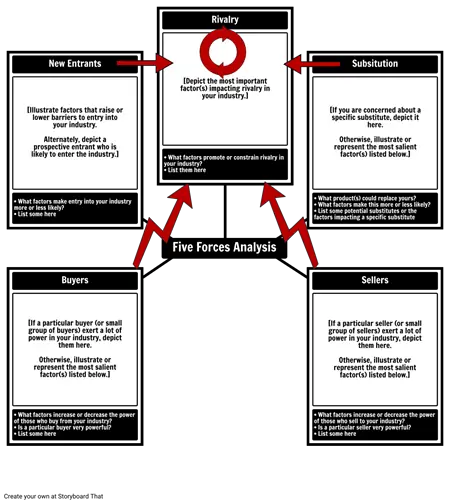

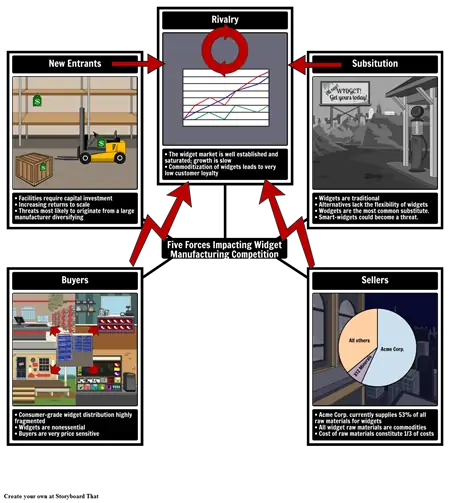

The five forces Porter includes in his analysis comprise threats from new entrants to an industry, rivalry from existing firms in the industry, the threat of substitution from outside the industry, and the respective power of buyers and sellers. Let’s look at each in turn.

Threat of New Entrants

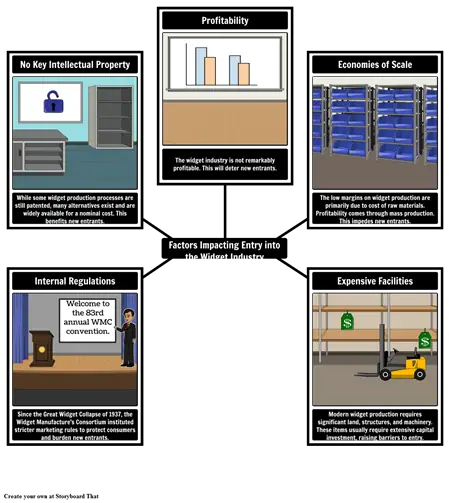

When a company has no competitors, they can charge almost any price for their product. As more and more competition enters the market, profits drop until joining the industry is not longer appealing to new ventures. Barriers to entry also deter this new competition and can result in monopolies if they become sufficiently high.

Some factors that increase barriers to entry:

- Required capital investments

- Key intellectual property

- Specialist knowledge or expertise

- Economies of scale

- Regulation, governmental or otherwise

Threat of Substitution

Substitution products are not simply a different brand (Pepsi vs. Coke), but an alternative product or service altogether (cola vs. root beer vs. mineral water). These alternatives aren’t competitors, they are a different industry, but they do threaten to substitute and reduce demand. The demand elasticity of a product can be a good proxy for how vulnerable it is to substitution.

Some important factors to consider:

- Relative prices of potential substitutes

- Relative performance of potential substitutes

- Ease of switching

- Customer inertia

- Cost of switching

Power of Buyers

In an industry that has only one consumer or a handful of very powerful consumers, these buyers have a significant impact. When Walmart or McDonald’s changes its food safety standards, this can have a ripple effect through all of their suppliers. The greater the asymmetry between the buyer and the supplier (the closer the relationship is to a monopsony) the more buyers can push for lower prices.

More factors to consider:

- Cost of switching to a new supplier

- Information available to buyers

- Essentialness of product to the buyer(s)

- Price sensitivity of buyers

- Total size of the market

Power of Suppliers

Suppliers is one market will be buyers in another, so the similar factors are at play (number of suppliers, cost of switching) but from a different angle. An additional factor to consider is the specialization of the supplier’s product, that is, whether they face threats of substitution.

Some other factors to consider:

- Employee solidarity

- Strength of distribution channels

- Existence of commodity products

- Ability of the buyer to move production in-house

- Influence of supplied item on cost

Competitive Rivalry

Where new entrants pose an external threat to companies, they also face competition from other established firms within their industry. Generally, the number and capability of competitors is the primary factor in determining the level of rivalry within a sector, but even excluding outright collusion, companies may adhere to informal codes of conduct that inhibit competition.

Specific factors that increase rivalry:

- Large number of firms

- Barriers to exit

- High fixed costs

- Low customer loyalty

- Slow market growth

Each of these forces creates pressure on the industry, pushing it towards perfect competition. Successful businesses can still apply their unique strengths (core competencies, networks, etc.) in these more perfectly competitive environments, but it becomes increasingly difficult to get an edge. For this reason, markets under less pressure are often seen as more profitable or attractive.

Using Porter’s Five Forces

How to Conduct an Analysis

One of the strengths of the five forces framework is its elegance. It isn’t difficult to perform a valuable analysis, though it will probably require some research. Start with the template below and list the factors contributing to each force.

Just like a SWOT analysis, list the factors in each category and illustrate the most salient. If it is helpful, you can further analyze factors in each category with an additional spider map.

When to Conduct an Analysis

Porter’s five forces analysis is an important tool for anyone trying to evaluate the strategic standing of an existing company, or considering a new venture into an existing industry. Even citizens looking to invest in a company can make use of the framework to estimate the future of the company in question.

Owners or officers of existing companies might conduct a five forces analysis, along with other tools like SWOT, and PEST, to understand external factors that might impact their business, how to increase their company’s resilience to environmental factors, or to reassess plans after a shift in the market.

Are you thinking of starting a small business? Opening a restaurant or food truck? Maybe an online store or service? Even a quick five forces analysis can help you determine the challenges you’re likely to face, and the opportunities you can capitalize on.

© 2024 - Clever Prototypes, LLC - All rights reserved.

StoryboardThat is a trademark of Clever Prototypes, LLC, and Registered in U.S. Patent and Trademark Office